Examine This Report on Medigap Plan G

Wiki Article

What Does Medicare Plan G Joke Mean?

Table of ContentsThe Buzz on Aarp Medicare Supplement Plan FFacts About Aarp Medicare Supplement Plan F UncoveredThe Only Guide to Manhattan Life AssuranceThe Ultimate Guide To Aarp Medicare Supplement Plan F10 Simple Techniques For Boomerbenefits.com ReviewsAll about Manhattan Life Assurance

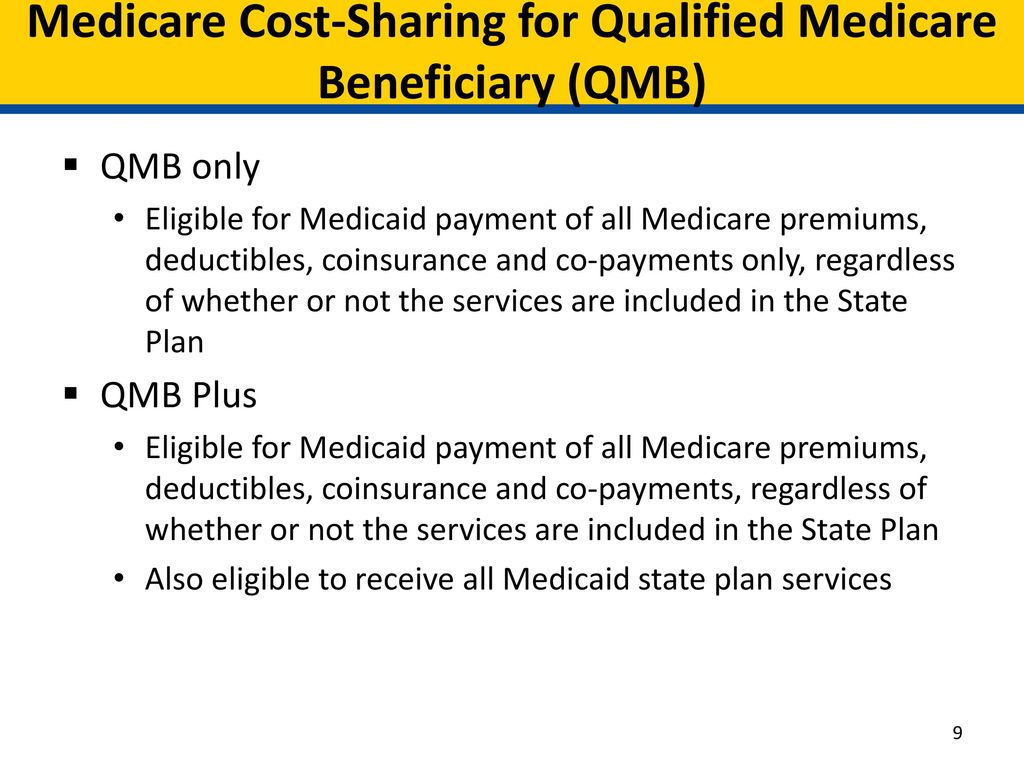

50 of the $185 accepted rate, provider will with any luck not be deterred from serving Mary or other QMBs/Medicaid receivers. - The 20% coinsurance is $37. Medicaid pays none of the coinsurance because the Medicaid price ($120) is less than the amount the company currently received from Medicare ($148) - aarp medicare supplement plan f. For both Medicare Advantage as well as Original Medicare, if the costs was for a, Medicaid would certainly pay the full 20% coinsurance no matter the Medicaid rate.If the company desires Medicaid to pay the coinsurance, then the service provider needs to register as a Medicaid supplier under the state regulations. This is an adjustment in plan in implementing Section 1902(n)( 3 )(B) of the Social Safety And Security Act (the Act), as modified by section 4714 of the Balanced Budget Act of 1997, which prohibits Medicare companies from balance-billing QMBs for Medicare cost-sharing.

QMBs have no legal responsibility to make more repayment to a copyright or Medicare managed care strategy for Component A or Part B cost sharing. Service providers who wrongly bill QMBs for Medicare cost-sharing are subject to permissions.

See this excerpt of the 2017 phone call letter by Justice in Aging - It can be tough to show a service provider that one is a QMB. It is particularly hard for suppliers that are not Medicaid companies to determine QMB's, because they do not have access to on-line Medicaid qualification systems If a consumer reports a balance billng trouble to this number, the Client Service Associate can escalate the issue to the Medicare Administrative Service Provider (MAC), which will certainly send out a conformity letter to the service provider with a copy to the customer.

Rumored Buzz on Plan G Medicare

(by mail), even if they do not additionally get Medicaid. The card is the device for wellness care suppliers to bill the QMB program for the Medicare deductibles as well as co-pays.A consumer that has an issue with financial debt collection, might additionally send an issue online or call the CFPB at 1-855-411-2372. TTY/TDD customers can call 1-855-729-2372. ought to grumble to their Medicare Advantage strategy. In its 2017 Phone call Letter, CMS worried to Medicare Advantage service providers that federal guidelines at 42 C.F.R.

Hyperlinks to their webinars as well as various other resources is at this web link. Their details includes: September 4, 2009, upgraded 6/20/20 by Valerie Bogart, NYLAG This post was authored by the Realm Justice.

Hence, members have to experience a redetermination to proceed getting benefits for the list below year. This procedure includes supplying your regional Medicaid workplace with updated information about your regular monthly earnings as well as total resources. If somebody doesn't have Part A yet is eligible, they can choose to sign up anytime throughout the year.

What Does Attained Age Vs Issue Age Mean?

The very first step in enrollment for the QMB program is to learn if you're qualified. A fast and also very easy means to do this is to call your regional Medicaid office - attained age vs issue age. The following action is to complete an application (aarp plan f coverage). You can request Medicaid to give you with an application type or situate a QMB program application from your Clicking Here state online.

There are instances in which states may restrict the quantity they pay healthcare service providers for Medicare cost-sharing. Also if a state restricts the amount they'll pay a copyright, QMB members still don't need to pay Medicare service providers for their health and wellness treatment prices and it's versus the regulation for a supplier to inquire to pay.

Typically, there is a costs for the strategy, yet the Medicaid program will pay that premium. Numerous individuals choose this added insurance coverage due to the fact that it provides routine oral and vision care, and some come with a fitness center membership.

Fascination About Plan G Medicare

Enter your zip code to pull strategy options readily available in your location. Select which Medicare plans you want to contrast in your area. Compare prices side by side with strategies & providers available in your location. Jagger Esch is the Medicare specialist for Medicare, FAQ and the owner, head of state, as well as CEO of Elite Insurance Allies and Medicare, FAQ.com.He is included in many publications in addition to writes routinely for various other skilled columns concerning Medicare.

Many states permit this throughout the year, however others restrict when you can enroll partly A. Bear in mind, states use various rules to count your earnings and also assets to establish if you are eligible for an MSP. Instances of income include incomes and Social Protection advantages you receive. Examples of properties consist of checking accounts as well as supplies.

All about Largest Retirement Community In Florida

20 for each brand-name medication that is covered. Bonus Assist just uses to Medicare Component D.If you're enrolled in the QMB program, the adhering to ideas will help make certain that your medical care expenses are covered: Allow a medical care expert know that you're enlisted in the QMB program. Show both your Medicare as well as Medicaid cards or QMB program card at any time you look for treatment. If you get an expense that must be covered by the QMB program, get in touch with the healthcare professional.

MSPs, consisting of the QMB program, are provided via your state's Medicaid program. That indicates that your state will establish whether or not you certify. Various states may have various methods to calculate your earnings and also resources. Allow's take a look at each of the QMB program eligibility standards in more information below.

Not known Facts About Boomerbenefits.com Reviews

Like revenue restrictions, the source limits for the QMB program are various relying on whether or not you're married. For 2021, the resource limitations for the QMB program are: $7,970 $11,960 Resource limitations likewise increase yearly. Just like income restrictions, you ought to still make an application for the QMB program if your sources have actually slightly raised.Report this wiki page